Subscribe to P2P-economy

Stay up to date! Get all the latest & greatest posts delivered straight to your inbox

SubscribeThis post will outline incentives for Solana token holders to stake SOL and earn rewards by securing the network.

Stake your SOL and earn up to 8% in staking rewards using our simple step-by-step guide for staking with Solflare Wallet and Ledger Nano S/X.

Inflation has been enabled in Solana allowing SOL delegators to earn rewards for contributing to the security and decentralisation of the network.

We've gathered the most important information related to SOL staking and inflation below. For more details, visit p2p.org/solana.

In order to compensate node operators for state validation and delegators for locking their funds, every epoch (~2-3 days), protocol issues new SOL based on emission rate called inflation. Every epoch staking rewards are added to the active stake automatically. Inflation parameter is defined on a protocol level representing annual emission percentage. The exact value of new minted SOL is recalculated every epoch based on the total supply.

Solana token emission is distributed among validator pools based on their stake weight in the network. Every epoch a special program on Solana calculates the weight of all active stakes and assigns points that are used to proportionally divide SOL rewards among participants for that period.

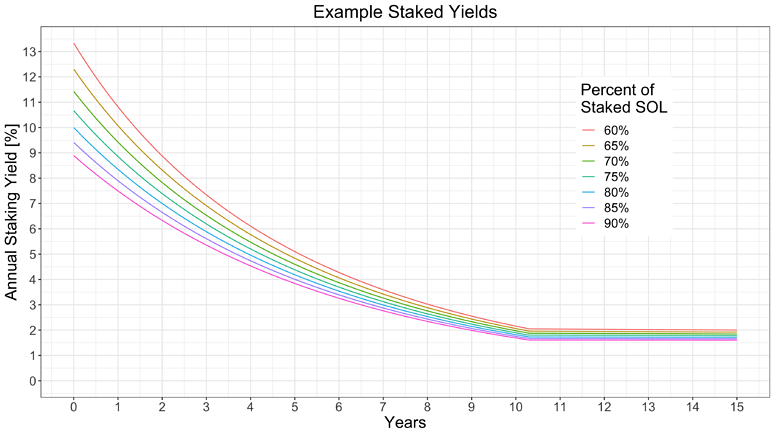

A decision about inflation rate value is very important for sustainable network growth. It should incentivize participants to stake, cover costs of operating for validators and at the same time avoid over dilution of network users. For the first year annual emission will constitute 8%. In the following years inflation percentage will be decreasing by 15% per year until emission reaches ~1,5%.

Another revenue source is derived from transaction fees. It is expected to be relatively low for the first years. In current implementation 50% of transaction fees is burned while the rest goes to the current leader who processed the transaction.

With the enabling of Solana inflation, SOL token holders are now able to earn rewards on their staked tokens.

In the beginning all Solana staking rewards will be distributed to validator pools. In the future, additional percentages from total issuance can be directed to the ecosystem development purposes and archivers, network participants who provide storage service downloading parts of the ledger and providing proof of replication of storing the segments.

The efficiency of Solana staking from an economic perspective depends on the overall participation. The total issuance is distributed to active delegators. If less than all SOL are staked, delegators will receive higher rewards than initial inflation.

For every epoch (2 days), the annual staking yield can be calculated using the formula:

APY = inflation * archiver_share * foundation_share / staking_ratio, where

staking_ratio = staked_tokens / total_supply

At time of launch, archiver_share and foundation_share are planned to be set to 0%, so 100% of emission will initially be going to validator pools. The first years will be the most attractive for Solana delegators representing an opportunity to increase the network share.

With the development of staking derivatives it will be possible to generate additional yield on top of staking rewards.

Special thanks to Eric Williams for valuable additions. Having trouble getting started? Please get in touch with a P2P representative by emailing [email protected] or ask for assistance in our Telegram chat.

P2P Validator is a world-leading non-custodial staking provider securing more than 3 billion USD value from over 10,000 delegators across 25+ high-class networks. We are early investors in Solana and have supported the network from the first block taking part in all stages of testing and voting.

Web: p2p.org

Stake SOL with us: p2p.org/solana

Twitter: @p2pvalidator

Telegram: t.me/P2Pstaking

Research & Analytics at p2p.org.

<p><em>The following guide walks you through the process of NEAR staking. This guide is for those who already have a funded NEAR account. If you don’t, go to </em><a href="https://wallet.near.org/?ref=p2p.org"><em>wallet.near.org</em></a><em> to set up an account.</em></p><hr><p>Near Protocol (NEAR) is an open-source platform which is designed to build and empower decentralised applications. NEAR token holders can stake their tokens to earn up to 11% APY. </p><p>The following guide walks you through the Near staking using <a href="https://wallet.near.org/?ref=p2p.org">Near Wallet</a>. Near Wallet is a Near specific wallet which lets you store, send and stake your tokens.</p><hr><h3 id="staking-near-protocol-near-video-guide">Staking Near Protocol (NEAR): Video Guide</h3><p></p><!--kg-card-begin: markdown--><iframe width="560" height="315" src="https://www.youtube.com/embed/aRXNQlEa4D4" title="YouTube video player" frameborder="0" allow="accelerometer; autoplay; clipboard-write; encrypted-media; gyroscope; picture-in-picture" allowfullscreen></iframe><!--kg-card-end: markdown--><hr><h3 id="staking-near-using-near-wallet">Staking NEAR using Near Wallet</h3><p></p><p>1. Import your account from <a href="https://wallet.near.org/?ref=p2p.org"><em>wallet.near.org/</em></a> and access it. If you use ledger make sure that firmware and NEAR application is up to date.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2022/01/image-1.png" class="kg-image" alt loading="lazy" width="2000" height="895" srcset="https://p2p.org/economy/content/images/size/w600/2022/01/image-1.png 600w, https://p2p.org/economy/content/images/size/w1000/2022/01/image-1.png 1000w, https://p2p.org/economy/content/images/size/w1600/2022/01/image-1.png 1600w, https://p2p.org/economy/content/images/size/w2400/2022/01/image-1.png 2400w" sizes="(min-width: 720px) 720px"></figure><p>2. Navigate to the <em>Staking</em> tab and press <em>Stake My Tokens.</em></p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2022/01/image-2.png" class="kg-image" alt loading="lazy" width="2000" height="630" srcset="https://p2p.org/economy/content/images/size/w600/2022/01/image-2.png 600w, https://p2p.org/economy/content/images/size/w1000/2022/01/image-2.png 1000w, https://p2p.org/economy/content/images/size/w1600/2022/01/image-2.png 1600w, https://p2p.org/economy/content/images/size/w2400/2022/01/image-2.png 2400w" sizes="(min-width: 720px) 720px"></figure><p>3. Look for a validator you wish to stake with or simply type its name in the search bar.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2022/01/image-3.png" class="kg-image" alt loading="lazy" width="2000" height="642" srcset="https://p2p.org/economy/content/images/size/w600/2022/01/image-3.png 600w, https://p2p.org/economy/content/images/size/w1000/2022/01/image-3.png 1000w, https://p2p.org/economy/content/images/size/w1600/2022/01/image-3.png 1600w, https://p2p.org/economy/content/images/size/w2400/2022/01/image-3.png 2400w" sizes="(min-width: 720px) 720px"></figure><p>4. Press on <em>Stake With Validator.</em></p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2022/01/image-4.png" class="kg-image" alt loading="lazy" width="2000" height="519" srcset="https://p2p.org/economy/content/images/size/w600/2022/01/image-4.png 600w, https://p2p.org/economy/content/images/size/w1000/2022/01/image-4.png 1000w, https://p2p.org/economy/content/images/size/w1600/2022/01/image-4.png 1600w, https://p2p.org/economy/content/images/size/w2400/2022/01/image-4.png 2400w" sizes="(min-width: 720px) 720px"></figure><p>5. Specify the amount you wish to stake or click on the <em>Use Max</em> button in case you want to delegate the whole available balance. Scroll down and press <em>Submit Stake</em>.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2022/01/image-8.png" class="kg-image" alt loading="lazy" width="2000" height="889" srcset="https://p2p.org/economy/content/images/size/w600/2022/01/image-8.png 600w, https://p2p.org/economy/content/images/size/w1000/2022/01/image-8.png 1000w, https://p2p.org/economy/content/images/size/w1600/2022/01/image-8.png 1600w, https://p2p.org/economy/content/images/size/w2400/2022/01/image-8.png 2400w" sizes="(min-width: 720px) 720px"></figure><p>6. Confirm staking in the new window.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2022/01/image-10.png" class="kg-image" alt loading="lazy" width="2000" height="787" srcset="https://p2p.org/economy/content/images/size/w600/2022/01/image-10.png 600w, https://p2p.org/economy/content/images/size/w1000/2022/01/image-10.png 1000w, https://p2p.org/economy/content/images/size/w1600/2022/01/image-10.png 1600w, https://p2p.org/economy/content/images/size/w2400/2022/01/image-10.png 2400w" sizes="(min-width: 720px) 720px"></figure><p>7. Approve the transaction on your hardware wallet if you use Ledger. You will be asked to authorize two transactions.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2021/02/7confirm-with-a-ledger.PNG" class="kg-image" alt loading="lazy" width="1893" height="868" srcset="https://p2p.org/economy/content/images/size/w600/2021/02/7confirm-with-a-ledger.PNG 600w, https://p2p.org/economy/content/images/size/w1000/2021/02/7confirm-with-a-ledger.PNG 1000w, https://p2p.org/economy/content/images/size/w1600/2021/02/7confirm-with-a-ledger.PNG 1600w, https://p2p.org/economy/content/images/2021/02/7confirm-with-a-ledger.PNG 1893w" sizes="(min-width: 720px) 720px"></figure><p>8. If everything is fine you will see a <em>Success</em> window. Your stake will start generating rewards from the next epoch (~12-14h). Those rewards are automatically added to the active stake. To <em>claim rewards or change a validator</em> you will need to <em>undelegate and wait for 36-52h</em> before withdrawing.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2022/01/image-11.png" class="kg-image" alt loading="lazy" width="2000" height="895" srcset="https://p2p.org/economy/content/images/size/w600/2022/01/image-11.png 600w, https://p2p.org/economy/content/images/size/w1000/2022/01/image-11.png 1000w, https://p2p.org/economy/content/images/size/w1600/2022/01/image-11.png 1600w, https://p2p.org/economy/content/images/size/w2400/2022/01/image-11.png 2400w" sizes="(min-width: 720px) 720px"></figure><hr><p><em>If you have any questions, feel free to ask in our </em><a href="https://t.me/P2Pstaking?ref=p2p.org"><em>Telegram chat</em></a><em>. We are always open for communication.</em></p><hr><h2 id="about-p2p-validator">About P2P Validator</h2><p>P2P Validator is a world-leading staking provider with the best industry security practices and proven expertise. We provide comprehensive due-diligence of digital assets and offer only top-notch staking opportunities. <strong>At the time of the latest update, more than three billion of USD value is staked with P2P Validator by over 10,000 delegators across 25+ networks</strong>. Our infrastructure is under advanced monitoring with alerts and 24/7 technical support making it the best choice for institutional investors.</p><hr><p><em><strong>Web</strong></em>: <a href="https://p2p.org/?ref=p2p.org">p2p.org</a><br><em><strong>Stake NEAR with us</strong></em>: <a href="https://p2p.org/near?ref=p2p.org">p2p.org/near</a><br><strong><em>Twitter</em></strong>: <a href="https://twitter.com/P2Pvalidator?ref=p2p.org">@p2pvalidator</a><br><em><strong>Telegram</strong></em>: <a href="https://t.me/P2Pstaking?ref=p2p.org">t.me/P2Pstaking</a></p>

from p2p validator

<h2 id="tldr">TLDR</h2><p>Due to an old version of an indexer agent combined with a short-time node desynchronisation, closed allocation resulted in a zero proof of indexing on February 6th 2021. Due to this rewards for the epoch vanished. Lost rewards will be fully compensated by waiving our fee and sharing our own indexing rewards with our delegators. </p><h2 id="what-happened">What happened?</h2><p>An oversight in an upgrade process led to the indexer-agent version being out of date. A minor hiccup in Ethereum node operation coincided with the allocation closing, resulting in the closing of an allocation without a proof of indexing being submitted. Rewards will be fully compensated over the course of 12 days by charging 0% fee and sharing our own indexing rewards. </p><h2 id="what-went-wrong">What went wrong?</h2><p>We provide regular reward stats on a daily/weekly basis for delegators with locked GRT and thus had no monitoring of epoch rewards after closing an allocation. This led to a minor delay in reaction as reports are filled automatically without human intervention. Right after realising that rewards had been lost we set up an internal investigation.</p><p>Additionally was the absence of a well-reviewed upgrade procedure for new indexer releases. The upgrade procedure had no clear standard and checklist of actions to follow. New allocations were opened and no technical mistakes occurred, but existing monitoring that allocation was insufficient. We noticed that monitoring for a subgraph syncing delay had insufficient resolution time-wise so failed to catch a small hiccup in Ethereum node operation.</p><h2 id="what-went-well">What went well?</h2><p>We close and open allocations on a daily basis so we lost only one day of rewards. We collect statistics on stake changes every day and spotted a problem with reward crediting. We also thank our delegators who have noticed the issue and pointed concerns out in our <a href="https://t.me/P2Pstaking?ref=p2p.org">Telegram channel</a>. </p><h2 id="impact-on-clients">Impact on clients</h2><p>All our Graph Network delegators lost one day of indexing rewards. To compensate and mitigate their loss, P2P will waive the fees for 12 days in addition to distributing all the rewards from our own indexer stake for that period. </p><h2 id="lessons-learned">Lessons learned</h2><p>We should have had monitoring for new version releases and checked that software is up to date before taking actions. To avoid such issues in the future we have defined a clear written procedure for upgrades and set monitoring for all necessary releases. This case revealed flaws in our existing monitoring so we have now initiated a deep analysis of all metrics improving it from ground up and adding necessary alerts to support this. </p><p>We have decided to make reviews for all standard operating procedures more rigorous by allocating more engineering time to these activities. Testing and improvement will be continued on the new testnet where we are already set up. All the crucial operations, upgrades and innovations that can potentially lead to a financial loss will be implemented on testnet first.</p><p>P2P takes full responsibility for this and we are sorry for the inconvenience. Please be assured that P2P is taking actions to eliminate even a small probability of such an event occurring in future.</p>

from p2p validator