Subscribe to P2P-economy

Stay up to date! Get all the latest & greatest posts delivered straight to your inbox

SubscribeNuCypher is a decentralized secret management network where a group of nodes (workers) perform proxy re-encryption to manage permissions on encrypted data instead of a centralized server. It allows safe data exchange without ability for proxies to learn the plain text info. Correctness of worker behavior is guaranteed by staking and cryptographic proofs. Additional token emission incentivizes node operators to maintain high availability infrastructure and in the case of network rules violation a portion of their holdings will be slashed.

NuCypher mainnet successfully launched on 15th October 2020 allowing token holders to stake their NU.

Privacy of sensitive data is a vexed problem and services provided by NuCypher project are attractive and valuable not only in crypto space. The highest growth of data breaches in USA was in the healthcare sector demonstrating 80% increase from 2017 to 2019 including the transmission of confidential data without proper encryption.

Enterprises also are seeking ways to avoid data leaks and securely manage and share sensitive data. The Global Key Management as a Service Market market size is expected to grow from $363 million in 2018 to $1,28 billion by 2023 and is estimated to reach $2,29 billion by 2025 during the period 2019–2025.

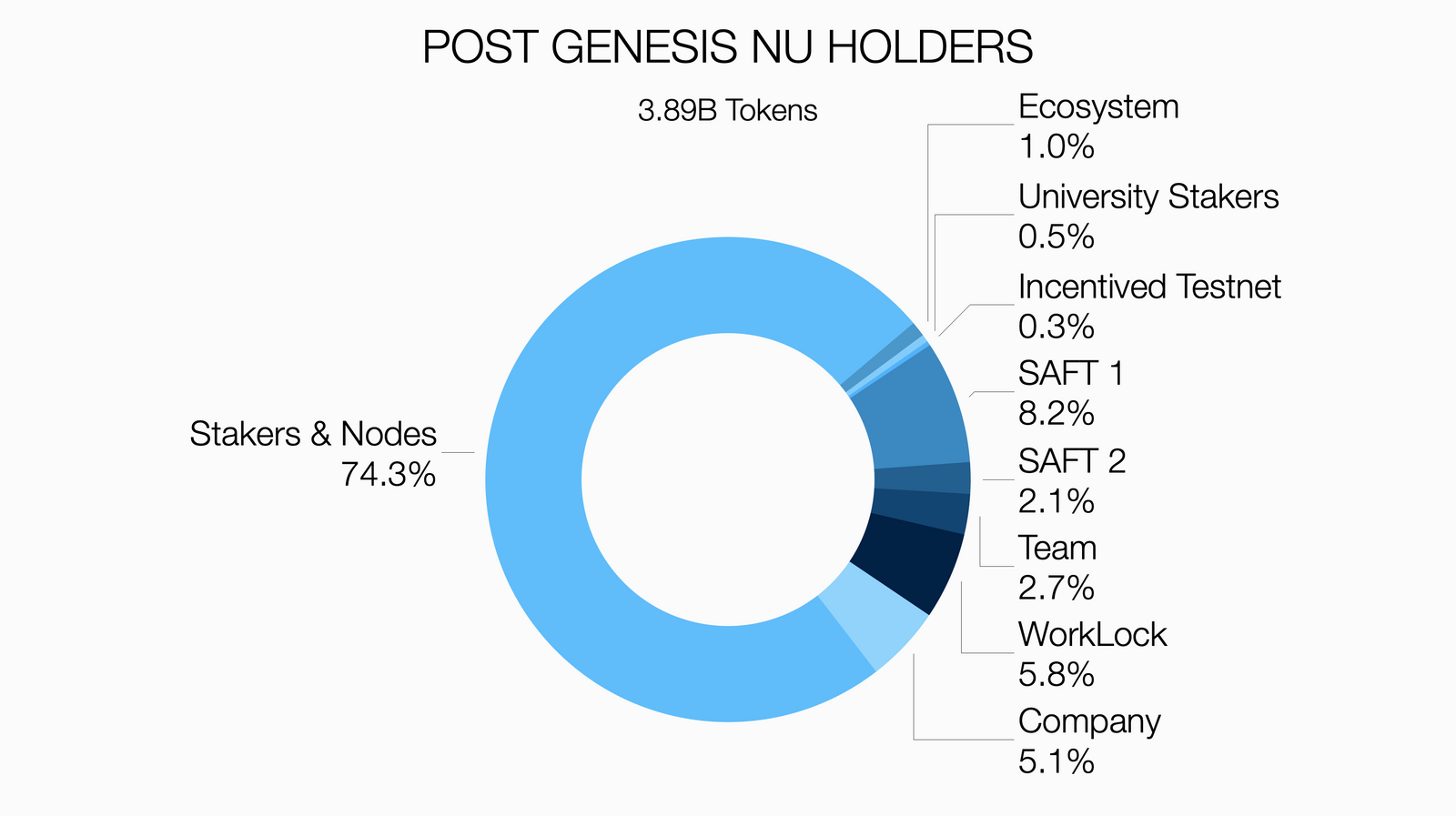

NuCypher raised $750k in 2016 ; $4.3 million in 2017 and $10,7 million in 2018. The overall token allocation showed in a diagram below.

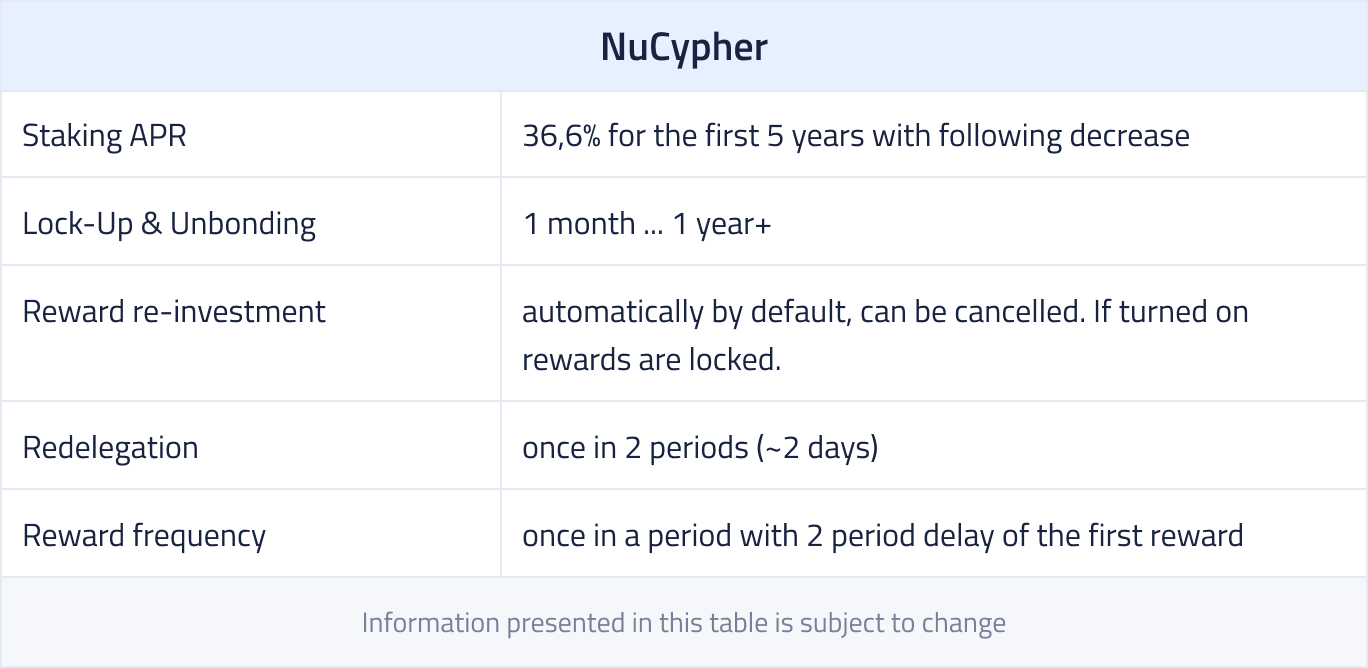

In order to participate in the network as a worker and perform re-encryption, node operators have to lock NU tokens. At the start rewards from providing re-encryptions might be low so until the project gets traction, node operators will be incentivized mostly by emission of new tokens. Holders can delegate their funds and earn a share of rewards in proportion to their stake.

Compensation is higher when tokens are locked for a longer period. To get maximum compensation stakers have to lock their funds for at least a year to be allowed to accept policies with longer terms. Shorter commitment will result in lower rewards for participants and they will not be allowed to provide re-encryption if the length of a particular policy is higher than chosen lock-up period. Staking since the beginning of mainnet with compounding of rewards also will result in higher returns. The whole stake can be split into sub-stakes where each will have its own lock-up period.

In existing representation only one staker can delegate to a worker in near future, staker can be a smart contract that accepts delegations from various addresses. We believe in future adoption of NuCypher and will provide the long term staking maximizing staking rewards.

NuCypher token NU is ERC20 token the main purpose of which is to act as a staking token in the network with limited liquidity and low volatility. Amount of provided re-encryptions will be proportional to stake which is guaranteed to be locked at the end time of the policy. Node operators with higher stake presuming higher loss in case of bad behavior and ability to accept policies with longer terms.

NuCypher based on Ethereum blockchain means that users should have ETH on the worker node’s address to pay tx fees. Workers also share service fees paid by end users in ETH for providing re-encryptions.

Over 350 000 ETH were locked in the smart contract by participants to take part in WorkLock token distribution model proposed by NuCypher team.

There are two potential slashing conditions:

At network genesis, the protocol will be able to detect and attribute instances of incorrect re-encryptions. If there are many sub-stakes and misbehavior occurs, unlocked tokens which do not participate in staking will be slashed in the first place and then ascending sub-stakes with lower lock-ups.

A false re-encryption is not like a double-sign. Correctness of a re-encryption can be proved via a zero-knowledge proof. If users receive incorrect re-encryption, they can provide this proof to the network, which will result in the node getting slashed. For each violation, 2×10−18 NU tokens will be deleted from the offender’s stake.

In the future, slashing parameters can be changed by the Decentralized Autonomous Organization (DAO) that is managed by NU stakeholders who operate nodes. It makes NuCypher a community driven project from the very beginning.

At network launch slashing for worker unavailability is turned off until it will be enabled by the DAO if needed. Stakers will not receive inflation rewards for any period the node is offline. A worker that doesn't timely apply updates and constantly experiencing downtime will also miss rewards.

P2P Validator is a world-leading non-custodial staking provider securing more than $3 billion by over 10,000 delegators across 25+ high-class networks. Our team has close connections with NuCypher and we have participated in the incentivized testnet since the beginning. P2P Validator invested its own funds in NuCypher project in 2017 and intends to support the network in the long term.

Want to stake NU with us? Alexey will be happy to help. Contact [email protected] to get personal assistance.

Research & Analytics at p2p.org.

<!--kg-card-begin: markdown--><p>This guide will walk you through the process of creating an account in Polkadot using Ledger hardware wallet and staking using a proxy account. If you have more than 200,000 DOT <a href="https://p2p.org/polkadot?utm_source=blog&utm_campaign=polkadot_ledger_guide" title="Get a special offer">contact us</a> to find out about our special staking conditions.</p> <!--kg-card-end: markdown--><div class="kg-card kg-callout-card kg-callout-card-grey"><div class="kg-callout-emoji">💡</div><div class="kg-callout-text">In a recent Polkadot update controllers’ accounts were depreciated in favour of proxy accounts. From now on it’s impossible to attach a controller account to a stash. The only remaining option is to directly connect a proxy account to the stash account, with the proxy granted limited rights.</div></div><p>To continue with Kusama switch the network and follow the same steps as for Polkadot.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2020/11/switch-2.PNG" class="kg-image" alt loading="lazy" width="1920" height="867" srcset="https://p2p.org/economy/content/images/size/w600/2020/11/switch-2.PNG 600w, https://p2p.org/economy/content/images/size/w1000/2020/11/switch-2.PNG 1000w, https://p2p.org/economy/content/images/size/w1600/2020/11/switch-2.PNG 1600w, https://p2p.org/economy/content/images/2020/11/switch-2.PNG 1920w" sizes="(min-width: 720px) 720px"></figure><!--kg-card-begin: markdown--><p><strong>Table of contents</strong><br> I. <a href="#create-polkadot-account-with-your-ledger">Create Polkadot account with your Ledger</a><br> II. <a href="#bond-the-amount-of-dot-you-wish-to-stake">Bond the amount of DOT you wish to stake</a><br> III. <a href="#nominate-validators">Nominate validators</a></p> <!--kg-card-end: markdown--><h3 id="create-a-polkadot-account-with-your-ledger">Create a Polkadot account with your Ledger</h3><p>Download <a href="https://www.ledger.com/ledger-live/download/?ref=p2p.org">Ledger Live</a> on your device and connect your hardware wallet. Make sure that Ledger firmware is up to date. Install the Polkadot/Kusama application.</p><figure class="kg-card kg-image-card"><img src="https://lh6.googleusercontent.com/y5-RjvLZp7Ka9cpLZgpzYWEA2UyyELASDYqnSX9xCaiximIeqfNi9qe7oIrycLqc4N_9xcApzSLJJesT7PveasSN7_85-pWocmgA1Ne8wQTUXoCL8lAl5tNY_Ixik3GQT0YETVI2" class="kg-image" alt loading="lazy"></figure><ol><li>Go to <a href="https://polkadot.js.org/apps/?rpc=wss%3A%2F%2Frpc.polkadot.io&ref=p2p.org#/settings">PolkadotJS UI</a> using Chrome and navigate to the <em>Settings</em> tab. In the dropdown menu related to hardware connections select<em> Attach Ledger via WebUSB </em>and press <em>Save.</em></li></ol><figure class="kg-card kg-image-card"><img src="https://lh3.googleusercontent.com/wMpvsexAYA8YDwB5xvt7cnKmMeuskWRcQLFdkwXqxVipjZHR8B7G64AAQsmv_cz1AYmEbr7WXd53ziAHgp0jvPvL0wlQJssWaLXV9qA_5y1BRWz96T6LiG5c8bRpGxFLSAa3ljv7" class="kg-image" alt loading="lazy"></figure><p>2. Go to the <em>Accounts</em> tab and press <em>Add Ledger </em>button to create an account</p><figure class="kg-card kg-image-card"><img src="https://lh4.googleusercontent.com/G_VJSqbDxNdUJGnvgV1F5-D1qrlEfN8o7XfgxQ6B1VG-B3vmJpWpByGEbVDsGPsb8Ps3G-mCDzYgkwyC2NaTGln33I9fQZ_c6pXZAO-sBMPovKcewsgJN_hHQntKeEnIXPDoILRg" class="kg-image" alt loading="lazy"></figure><p>3. On your Ledger wallet, navigate to the Polkadot/Kusama app that you downloaded in Step 1 and select it by pressing two buttons on your Ledger. Go back to the screen on your device and click <em>Save</em>.</p><figure class="kg-card kg-image-card"><img src="https://lh4.googleusercontent.com/L659ZpiW6Awwsr3GmoRsG5m8VZ6C8zTdcnWyQSonlQ4_trJt5qS8qQ4GpvPUMQTpDX7JkHMa5Rw7GY2ijb-gS5HJKHX47vS-iFDBGm65e9YFbYGZhPdkfKtDyWXlB8-l33CvjAJx" class="kg-image" alt loading="lazy"></figure><p>4. You will be asked to confirm the connection of your Ledger via web interface. Select it in a dialog window and press <em>Connect.</em></p><figure class="kg-card kg-image-card"><img src="https://lh5.googleusercontent.com/IgDYDyvEm6v5Bac0aWSZHWAYa3nGoWrlWoSRv8-zKna3pIv_b637HJgz1nBeKfuxV7EZ0rkJv-HPLOWu2tMdKCwqbzH_A2WomgkGf9ZuKYxgWmttk8Th7BvqHypMnpR53kQi3YyT" class="kg-image" alt loading="lazy"></figure><!--kg-card-begin: markdown--><ol start="5"> <li>The account should appear on the screen. This account will play the role of your stash. If your stake is higher than 200k DOT - <a href="https://p2p.org/polkadot?utm_source=blog&utm_campaign=polkadot_ledger_guide" title="Get a special offer">contact us</a> to receive a special offer from P2P. To generate multiple addresses repeat steps 3,4 but every time choose a different address index in the drop-down menu of step 3.</li> </ol> <!--kg-card-end: markdown--><p>We will continue with a single account but if there are multiple ones the following process should be repeated for each of them.</p><figure class="kg-card kg-image-card"><img src="https://lh3.googleusercontent.com/zOgHQZdtDfwmwYfC1i7iGeVgvEJ_sJhP3oKFx7Wm_XgeX23okGrNYzmMK4Jm67G4gduYAOFD1zmJqHvwyW4sqrq1MP7VzdU_Xi500EK3aBAMO7rkeDVjkBamSt2qqluK7dzOMFtO" class="kg-image" alt loading="lazy"></figure><p>Left-click on the icon to copy the address and send DOT tokens to it.</p><h3 id="bond-the-amount-of-dot-you-wish-to-stake">Bond the amount of DOT you wish to stake</h3><ol><li>Go to <em>Network -> Staking </em>and navigate to <em>Account Actions </em>by pressing the tab.</li></ol><figure class="kg-card kg-image-card"><img src="https://lh5.googleusercontent.com/s5zgusv6II9zV9uYwRs_XXChVpkxFyncnWQ9TW2NTrgW20h0cQk4ZExuIi7KPAFYDSAS7kmsWvmWQKBCNHx8NaoDRcn9t7D-48uMIMVl9xbaGN0sAdNvSUGnm1NWIXFOx3cHpQhl" class="kg-image" alt loading="lazy"></figure><p>2. Bond the amount you wish to stake. Leave at least 2-3 DOT unbonded to cover future transaction fees. In the dropdown menu you can specify the desired way of receiving rewards. There are several options available: Staked (auto compound rewards); Stash (send rewards to the stash account); Controller (send rewards to the controller account); Account (send rewards to any 3rd party account).</p><figure class="kg-card kg-image-card"><img src="https://lh6.googleusercontent.com/w1Nng_MmpnpKj3tpEKx2B5_OinchL7uSjJt69asmImIIrT1APTYkusX_S-CtnCLwJKh9HmyXg0Iov4GARnX4ZwNZXesYhIlZAWCbQmmXHX2u10759UzH7uEqFJtNcJn7KnRUHF11" class="kg-image" alt loading="lazy"></figure><p>We make payouts every day or three so you won’t need to pay a tx fee by yourself.</p><p>3. Press <em>Sign and Submit,</em> then confirm the transaction on your Ledger device</p><figure class="kg-card kg-image-card"><img src="https://lh4.googleusercontent.com/vVURso4mV9O0Dq0j82rfft7FsT6mol--8_SCr4zAbGuPpxiS7FXv9XMpIUGkt7aiEYVpm2Sj-KBWbJlRPgOraokh0XX57DAvyJizmuEi0fQEnXYGDNZFGniz7kKnFfM4TCkB1FIh" class="kg-image" alt loading="lazy"></figure><p>If the hardware wallet becomes disconnected, re-enter the Polkadot application and continue making actions on the PolkadotJS screen. You will be asked to connect Ledger via web interface as in step 5, after that continue with the step where the connection was lost.</p><p>4. After successful bonding your stash appears in the <em>Account Actions </em>tab. We recommend assigning a proxy account. It is a separate account that you should fund with 2-3 DOT and connect with your primary one to perform staking related operations on behalf of your stash, like triggering payout or nominating a validator. A staking proxy has no access to the funds on the stash account.</p><h3 id="nominate-validators">Nominate validators</h3><ol><li>Press <em>Nominate </em>button</li></ol><figure class="kg-card kg-image-card"><img src="https://lh3.googleusercontent.com/cgkEcRpMBOxmnhmqOMUQ8vEjSJFzpixp3hKjZZKuH8cO49tdW92pYgHzqWXP-b_HM20jnXlnh7iyKJvjbD3jzucmQ_DlBb9XCYFA6WnBoUIG78TzII93Nja93ZQPVjGti8TfFPkC" class="kg-image" alt loading="lazy"></figure><p>2. In the opened window select up to 16 validators you wish to stake with. If you would like to nominate P2P go to <a href="https://p2p.org/polkadot?ref=p2p.org">https://p2p.org/polkadot</a> and select validators from there. We update the list on a regular basis.</p><figure class="kg-card kg-image-card"><img src="https://lh6.googleusercontent.com/fS5UnK-NZvAPCLEbSlIqcm4B7w-4Q9FD2XO6C68e8wMQw0HE9mkbMJSNSucCjeg_hadaXhOyZaqeLrng68frTAZjgs8pOK3juLy3oeTcd6-JUouv9CVOF5aFkujqgLt3ZbfH_SWA" class="kg-image" alt loading="lazy"></figure><p>3. Chosen validators will appear in the right column. Press <em>Nominate.</em></p><figure class="kg-card kg-image-card"><img src="https://lh4.googleusercontent.com/OQk6oaLdyU7oMzLRNUMcIyDEwWaOa3Kls269kUHf2ZZQgNCSDplnPWnxeLhqwaIWZecWU3msVQdZECm8vEuh-OcVViPbZSm_t8iX9HnCoQCEJ6SQikEpapb6VRql7NGgXJiVK3oa" class="kg-image" alt loading="lazy"></figure><p>4. You may perform staking actions from both stash and proxy accounts. We recommend to use your proxy account for staking actions.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2020/11/Sign---submit-ser.PNG" class="kg-image" alt loading="lazy" width="1920" height="865" srcset="https://p2p.org/economy/content/images/size/w600/2020/11/Sign---submit-ser.PNG 600w, https://p2p.org/economy/content/images/size/w1000/2020/11/Sign---submit-ser.PNG 1000w, https://p2p.org/economy/content/images/size/w1600/2020/11/Sign---submit-ser.PNG 1600w, https://p2p.org/economy/content/images/2020/11/Sign---submit-ser.PNG 1920w" sizes="(min-width: 720px) 720px"></figure><p>5. In the top right corner you should see that transaction is confirmed. Your screen should be updated and current nominations should appear in the <em>Account Actions </em>tab. From here you will be able to manage your staking in future.</p><figure class="kg-card kg-image-card"><img src="https://lh4.googleusercontent.com/6W7zmuhtnP062W3Nvm2xdv-snh07v580ogpm-s5j1vOVJE6TF-W5LEojRqld7NFtjQA6SSVhTzf54alOPEFGNRjPhHJioEvvQUkJxdmgh8rnUuXKAFPyVEm7pmVx-apyCvlwR71y" class="kg-image" alt loading="lazy"></figure><p>Staking will begin from the next era or two (24 - 48 hours). You will be able to track nominations from <em>Staking -> Account Actions. </em>At least one nomination should become active thus your stake is working in full and generating rewards.</p><h3 id="ledger-guides">Ledger guides</h3><ol><li><a href="https://support.ledger.com/hc/en-us/articles/360018131260?docs=true&ref=p2p.org">Ledger’s guide on staking Polkadot (DOT) thought Ledger Live</a></li><li><a href="https://support.ledger.com/hc/en-us/articles/7402653416477-How-to-use-the-Polkadot-Staking-Dashboard?docs=true&ref=p2p.org">Ledger’s guide on using Polkadot Staking dashboard</a></li><li><a href="https://support.ledger.com/hc/en-us/articles/4403056215825-Set-up-and-use-polkadot-js-to-access-your-Ledger-Polkadot-DOT-accounts?docs=true&ref=p2p.org">Ledger’s guide on set up and use polkadot js to access your ledger Polkadot (DOT) accounts</a> and <a href="https://support.ledger.com/hc/en-us/articles/4416512532625-Set-up-and-use-polkadot-js-to-access-your-Ledger-Kusama-KSM-account?docs=true&ref=p2p.org">guide Kusama (KSM) accounts</a></li><li><a href="https://support.ledger.com/hc/en-us/articles/7533743296797-How-to-join-a-Polkadot-nomination-pool?docs=true&ref=p2p.org">Ledger’s guide on how to join a polkadot nomination pool</a></li></ol><h1 id="about-p2p-validator"><strong>About P2P Validator</strong></h1><p><a href="https://p2p.org/?ref=p2p.org">P2P Validator</a> is a world-leading non-custodial staking provider securing more than $3 billion by over 10,000 delegators/nominators across 25+ high-class networks. We have been presented in all Polkadot testnets and have been actively participating on Kusama network since the beginning. P2P Validator invested its own funds in Polkadot in 2017 and intends to support the network in the long term.</p><hr><p>Do not hesitate to ask questions in our <a href="https://t.me/P2Pstaking?ref=p2p.org">Telegram </a>chat or contact Alex via [email protected]. We are always open to communication.</p><hr><p><strong>Web:</strong><a href="https://p2p.org/?utm_source=blog&utm_medium=economy&utm_campaign=polkadot_nominate"> https://p2p.org</a><br><strong>Stake DOT with us:</strong><a href="https://p2p.org/polkadot?ref=p2p.org"> https://p2p.org/polkadot</a><br><strong>Twitter:</strong><a href="https://twitter.com/p2pvalidator?ref=p2p.org"> @p2pvalidator</a><br><strong>Telegram:</strong><a href="https://t.me/P2Pstaking?ref=p2p.org"> https://t.me/P2Pstaking</a></p>

from p2p validator

<p>Oasis protocol is a decentralized privacy-preserving platform for cloud computing that allows safe data sharing and ownership enabling computationally complex applications. Oasis provides confidentiality at every layer of the protocol. The network is secured by proof-of-stake where the rectitude of validators responsible for consensus and nodes providing computations is provided by slashing in case of misbehavior. At the outset, validators are incentivized by gradually decreasing emission schedule and transaction fees.</p><h3 id="current-state-and-market-potential"><strong>Current state and market potential</strong></h3><p>Oasis team plans to launch Mainnet Beta (fully featured network with disabled transfers) soon after Mainnet Dry Run that is launched to ensure that the network is healthy.</p><p><a href="https://www.gartner.com/en/newsroom/press-releases/2019-04-02-gartner-forecasts-worldwide-public-cloud-revenue-to-g?ref=p2p.org">Gartner projects</a> the market size and growth of the cloud services industry at nearly three time the growth of overall IT services by 2022. According to IDC forecast worldwide spending on public cloud services and infrastructure is set to double growing from $229 billion in 2019 to almost $500 billion by 2023.</p><p>At the same time more data is stored in the clouds posing higher security and privacy risks which are the most concerning for data owners. The danger of cloud breach <a href="https://leftronic.com/cloud-computing-statistics/?ref=p2p.org">has increased by 18.4% since 2016 while 60% of companies</a> use cloud technology to store confidential data.</p><p>Oasis team addressed privacy issues by implementing<a href="https://docsend.com/view/3aznduk?ref=p2p.org"> Ekiden</a> that allows nodes to perform computations off-chain in a trusted execution environment without access to the data itself.</p><h3 id="token-allocation-and-purpose"><strong>Token allocation and purpose</strong></h3><p>Oasis Labs raised $45 million. The overall token allocation presented in the graph below. Total supply is capped at 10 billion ROSE. For staking rewards foundation allocated ~2 billion ROSE.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2020/09/token-dist-oasis-pie.png" class="kg-image" alt loading="lazy" width="695" height="371" srcset="https://p2p.org/economy/content/images/size/w600/2020/09/token-dist-oasis-pie.png 600w, https://p2p.org/economy/content/images/2020/09/token-dist-oasis-pie.png 695w"></figure><p>Oasis native token is a staking unit with limited liquidity and low volatility serving the purpose of securing the network and incentivizing nodes to follow the protocol rules. Transaction fees are also denominated in ROSE as well as a payment for provided computations after this feature will be enabled.</p><p>There will be no public sale due to regulation risks. To acquire tokens you should wait for official announcements from the Oasis team and listing on exchanges.</p><h3 id="staking-economics"><strong>Staking economics</strong></h3><p>Oasis currently uses Tendermint consensus. Nodes performing confidential computations utilize TEEs to execute smart contracts and do not have access to the data itself while validators finalize transactions and update the state of the blockchain. Oasis network will launch with a focus on the consensus layer of the protocol. <strong><strong>To begin with, rewards from staking will be </strong>~<strong>15% and then decrease to 1</strong>2<strong>%</strong> in six month.</strong> Holders can delegate their funds increasing overall security of the network and earn a share of rewards in proportion to their stake. There is a minimum required delegation of 100 tokens. Staking since the beginning of mainnet will result in higher returns for delegators.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2020/09/table-8-1--1.png" class="kg-image" alt loading="lazy" width="1368" height="620" srcset="https://p2p.org/economy/content/images/size/w600/2020/09/table-8-1--1.png 600w, https://p2p.org/economy/content/images/size/w1000/2020/09/table-8-1--1.png 1000w, https://p2p.org/economy/content/images/2020/09/table-8-1--1.png 1368w" sizes="(min-width: 720px) 720px"></figure><h3 id="slashing-risks"><strong><strong>Slashing risks</strong></strong></h3><p>At the time of mainnet launch, the protocol will slash <strong><strong>only for double-signing</strong></strong>. At the start the <strong><strong>minimum amount of 100 tokens will be slashed</strong></strong> and node functioning stopped in order to prevent the node from being over-penalized and resulting in losing delegations. Validators will have to change operating address and attract delegations to participate in consensus. There is <strong><strong>no slash for liveness or uptime at launch</strong></strong>, but a node would need to sign at least 75% of blocks in the epoch to receive corresponding rewards.</p><h3 id="about-p2p-validator"><strong><strong>About P2P Validator</strong></strong></h3><p><a href="https://p2p.org/?ref=p2p.org">P2P Validator</a> is a world-leading non-custodial staking provider securing more than $3 billion trusted by over 10,000 delegators across 25+ high-class networks. Our team has close connections with Oasis team and we have participated in the incentivized testnet since the beginning. P2P Validator invested its own funds in Oasis project and intends to support the network in the long term.</p><h3 id="useful-oasis-resources"><strong><strong>Useful Oasis resources</strong></strong></h3><p>Website:<a href="https://www.oasislabs.com/?ref=p2p.org"> https://www.oasislabs.com/</a></p><p>Github:<a href="https://github.com/oasislabs?ref=p2p.org"> https://github.com/oasislabs</a></p><p>Whitepaper:<a href="https://docsend.com/view/grdq39h?ref=p2p.org"> https://docsend.com/view/grdq39h</a></p><p>Non-tech paper:<a href="https://docsend.com/view/5uuhcj3?ref=p2p.org"> https://docsend.com/view/5uuhcj3</a></p><p>Blog:<a href="https://www.oasislabs.com/blog?ref=p2p.org"> https://www.oasislabs.com/blog</a></p><hr><p><em><em>Want to stake Oasis with us? </em>Paul <em>will be happy to help. Contact</em></em> <em>p.pavlov<em>@p2p.org</em></em> <em><em>to get personal assistance.</em></em></p><hr><p><strong><strong>P2P Validator</strong></strong> provides secure non-custodial staking. Subscribe to our channels and stay tuned for updates and new blog posts.</p><p><strong><strong>Web:</strong></strong><a href="https://p2p.org/?ref=p2p.org"> https://p2p.org</a></p><p><strong><strong>Twitter:</strong></strong><a href="https://twitter.com/p2pvalidator?ref=p2p.org"> @p2pvalidator</a></p><p><strong><strong>Telegram:</strong></strong><a href="https://t.me/p2pvalidator?ref=p2p.org"> https://t.me/p2pvalidator</a></p>

from p2p validator