Subscribe to P2P-economy

Stay up to date! Get all the latest & greatest posts delivered straight to your inbox

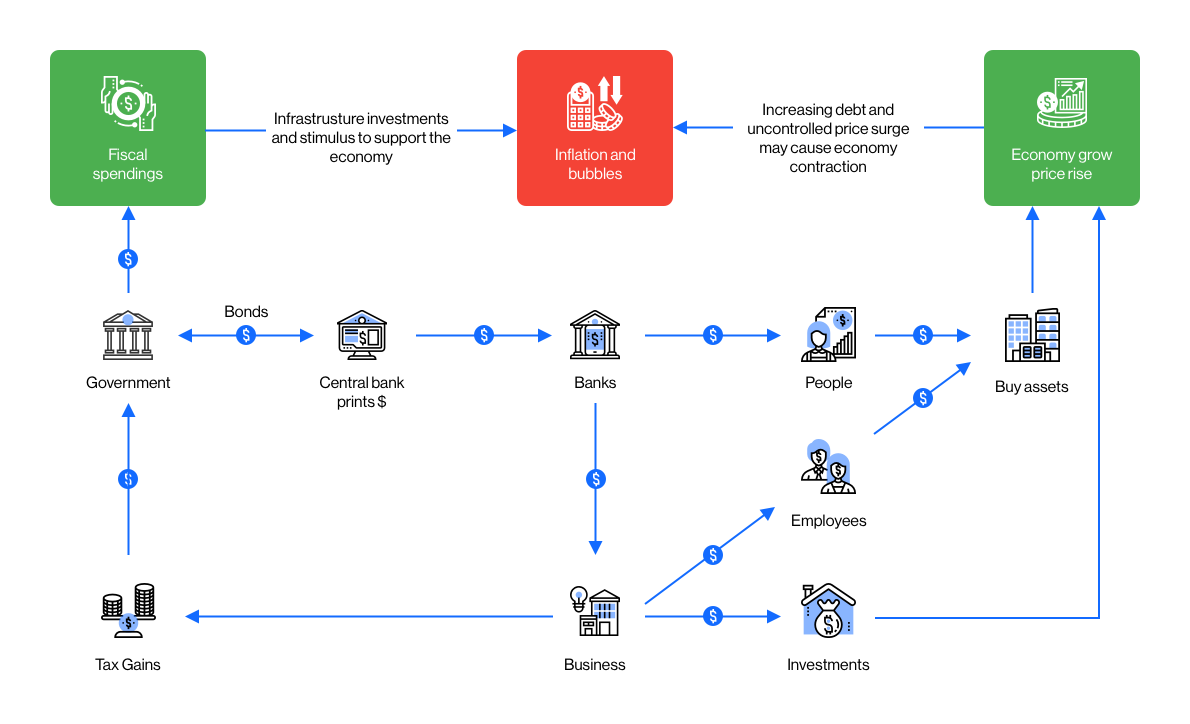

SubscribeIt is not a secret that governments control the money printing press. It is a powerful tool that allows the filling of the economy with liquidity when it is needed. This process usually dilutes share of currency holders and causes an inflation surge, but also may boost spendings and ability of entrepreneurs to borrow cheaper and pay their employees thus resulting in higher employment rates leading to higher tax returns for the government. Wise usage of currency emission allows governments to accumulate rising tax gains and earn interest rate paid on issued money, which are in fact profit from money creation - seigniorage. These gains are used to stimulate fiscal spending and support economic growth.

One of the most common uses of money is as a convenient unit of exchange for buying goods and services. To earn some, people can produce goods or provide some useful services, but they do not have an opportunity to earn profit from the emission. This process is monopolized by centralized entities. But, imagine there is an option to participate in a novel currency emission and have rights to get a portion of seigniorage in an algorithmic and decentralized manner?

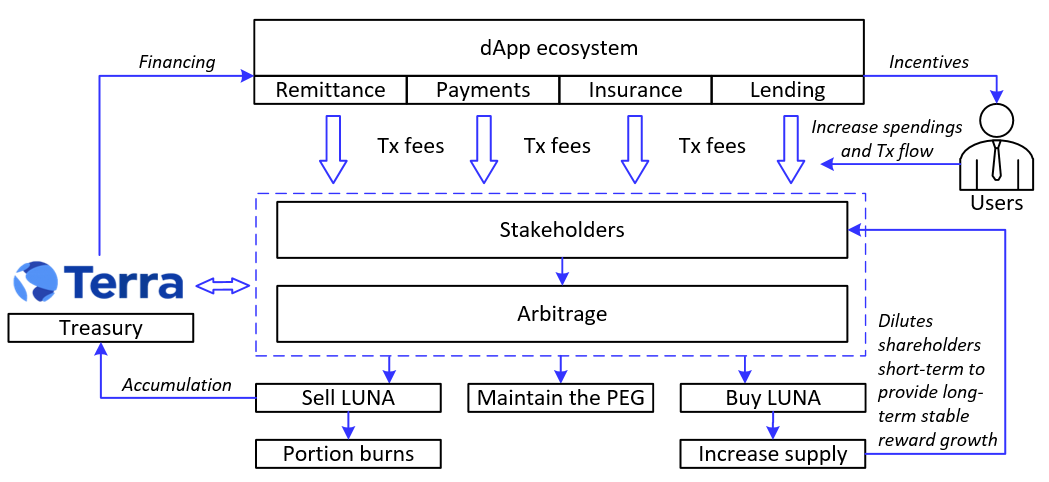

Terra project implemented the best practices of government fiscal policy and fulfilled them with solid additions that benefit e-commerce platforms (providers) and users as well. The concept combines features of cheap cross-border transactions in stablecoins and the ability for every user to participate in the growing e-commerce economy pretending on portions of transaction fees and seigniorage profit returning capital back to the people.

The core idea of Terra project is to bring on the market a stable family of cryptocurrencies without the necessity to store fiat collateral in the centralized bank and allow parties to transact not worrying about high volatility. This is very important for the crypto community and worldwide adoption. To achieve that goal, Terra developed a complex algorithm of price stabilization, which I will try to explain later.

There are three types of stablecoin implementations:

Family of Terra stablecoins represent the second type and include various coins maintaining the peg to different currencies, like USD, KRW, and EUR. The less volatile stablecoin in that group is pegged to a basket of currencies SDR IMF. To provide conversions between currencies, the protocol supports atomic swaps at the fair fiat exchange rate. This allows Terra to offer foreign exchanges efficiently and simplify cross-border payments.

Another important part of Terra project is a staking token LUNA. LUNA may be considered as a decentralized collateral, representing a buffer absorbing volatility. It captures the value of the transaction flow and redistributes it among stakeholders (everyone who stake) creating incentives for them to care about low volatility of stablecoin family. Terra protocol utilizes Tendermint consensus mechanism and another important purpose of staking token is securing the network creating incentives for validators, who play roles of price oracles for inner currency exchanges and broadcast transactions in the network to behave in the interests of the ecosystem and properly provide their services.

Without fiat collateral and centralized control over the “printing press” it is not easy to provide price stability and control the total supply as well as inner economics in general. To create the market for the own currency, Terra united an alliance of e-commerce providers in Asia who are interested in using stablecoins as a payment method offering it to their customers. Terra money is issued in a decentralized manner depending on the demand and total market size.

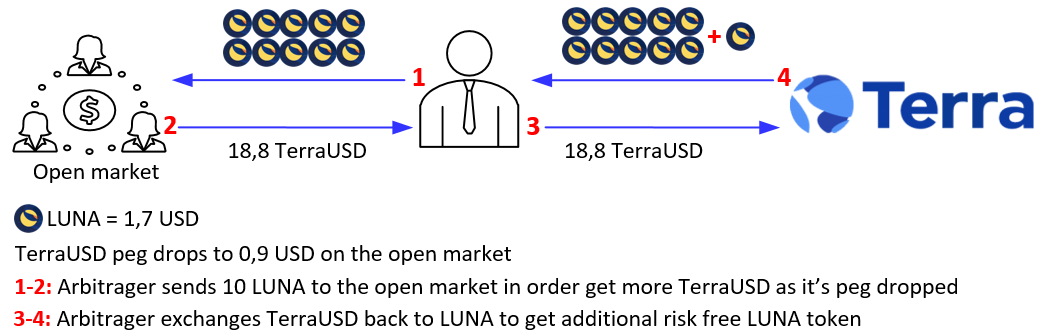

For example, if existing supply is not high enough, when transaction volumes grow significantly, demand for stablecoins may also increase. The price of a single unit may rise creating an arbitraging opportunity for the payment network participants who stake LUNA. They can exchange one to another with the inner price, and benefit from its deviations out of the peg. In response, to provide the exchange protocol mints requested amount of currency that can be used to release risk-free profit on the open market returning the peg.

When protocol gets tokens in exchange for minting it distribute a part of that provisions to the treasury burning the rest with a burn rate which is defined by the protocol and depends on changes in the macroeconomic variables. This module is playing the role of decentral algorithmic bank regulating a transaction fee rate and weight of seigniorage that goes to stakers.

When the economy is in the growth stage, spendings are high. People purchase more goods and services. That results in rising inflation. When inflation surges people cut spendings, slowing them down. It leads to lower profits for companies resulting in the inability to pay their debts or make investments. The economy slows down. To fix it, according to a Keynesian approach, when the economy is rising and families spend a lot, Central Banks should do the opposite to control inflation and be able to step in when the economic cycle is moving closer to a recession. That is exactly the way how the economy is functioning today.

Treasury module is doing exactly the same for Terra economy. In periods of growth and rising transaction volumes it increases accumulation of LUNA earned in exchange for minting Terra by decreasing the burn rate. When the economy begins to contract in the cycle of lower transaction volumes Terra protocol facilitates spendings using accumulated funds in the treasury, bootstrapping stable demand and economic growth. Another purpose of these provisions is to provide discounts for usage of Terra stablecoin as a payment. If people prefer to pay that way, it obviously creates additional incentives for e-commerce providers to join the Terra network.

The core priority for the success of such a system is to create strong incentives for LUNA staking even in periods of instability. This mechanism works like programmatically determined equalizer, managing LUNA burn rate and transaction fee rate which together represent staking rewards. To provide stable staking reward growth, protocol measure and balance these components depending on the economic variables.

burn rate is high it rewards holders as staking power of their assets is rising. To smooth that growth, protocol decreases the transaction fee rate.burn rate is low it dilutes holders and staking power is falling. To compensate that, protocol increases the transaction fee rate.Terra may be applied to various sectors with different decentralized applications (dApps) built on top creating multiple token economies managed by the single programmable module. Treasury funds will be filling from various sources. Growth cycles and inflow changes from one sector will cover a decline in another.

Capital allocations for dApps development would be managed by the network participants in a decentralized manner via governance. Every LUNA holder may cast a vote taking into consideration actual results of a particular dApp measuring potential benefit. This model creates motivation for dApp providers to investigate new incentive models and offers a unique value proposition competing with others for capital allocation.

In existing centralized decision making on fiscal spending, a small group of people decide how resources should be allocated. There is a high probability of corruption schemes or lobbying interested parties. In those cases, resources may not be spent efficiently. Future economic outcomes may suffer, undermining the entire ecosystem.

Terra is aimed to become a convenient medium of exchanging programmable money that enables easy foreign currency swaps and cross-border payments bridging traditional economies with advantages of decentralization.

An optimal economic resources distribution, a sophisticated stability mechanism, strong network effects and an ability to provide incentives for users is a big step towards mass adoption for digital currency. Now the community can participate in the economy that distributes wealth back to society without the need to trust a limited group of individuals, that may be accumulating lots of money and power, fighting their desire to put some in their own pockets.

I am not an economist or financial adviser, all opinions expressed in this article are my own thoughts on that topic. Special thanks to Do Kwon and Nicholas Platias for their answers and assistance. For deeper dive into the protocol concepts you may visit Agora, Terra research forum.

P2P Validator offers high-quality staking facilities and provides up to date information for educational purposes. Stay tuned for updates and new blog posts.

Web: https://p2p.org

Stake LUNA with us: https://p2p.org/terra

Twitter: @p2pvalidator

Telegram: https://t.me/p2pvalidator

Research & Analytics at p2p.org.

<p>Currently, 6 validators control more than <code>33%</code> of Cosmos Hub voting power with <strong><strong>over 62 000 000 ATOM</strong></strong> at stake <strong><strong>(>313 000 000 USD)</strong></strong>. Their <a href="https://medium.com/@hector_89360/cosmos-hub-validators-rich-list-9ed69274e5e?ref=p2p.org">monthly revenues</a> are sustainable and in most cases, are high enough to behave in interests of the Cosmos ecosystem even if they are technically able to collude. Their income is also sufficient to maintain reliable infrastructure, provide high level of security and upgrade their facilities. If we will look at validators from 80 to 100 we may notice that they have around <strong><strong>1 252 370 ATOM</strong></strong> at stake <strong><strong>(6 261 850 USD)</strong></strong>. Monthly revenues of a single validator in this group, in most cases, do not exceed <strong><strong>1000 USD</strong></strong>. Most likely, it is not enough to provide sustainable improvements, cover running costs, pay salaries to the employees and add value to the ecosystem. If we would broaden validators set and add 25 more, their revenues, probably, would be even less. Their ability to provide secure services in the long term is questionable as well as ability to compete and attract new delegators.</p><p>Situation with network decentralization will not change vastly, last 20 validators have total voting power less than <strong><strong>0,75%</strong></strong>. Taking that into consideration we suggest that additional 25 validators will not add more than <strong><strong>0,5%</strong></strong> creating state of the ecosystem where <strong><strong>36%</strong></strong> of validators have less than <strong><strong>1,25%</strong></strong> of voting power making power distribution even more irrational. This issue should be addressed before raising the threshold to establish fair distribution and define a bottom border of entering the validator's set.</p><p>These validators will have higher risk of slashing with lower cost increasing economic viability of such a harmful behavior. For example, the cost of double-sign for Polychain Labs is higher than <strong><strong>3 000 000 USD</strong></strong> while the average cost of double-sign for validators from 80-100 is close to <strong><strong>15 000 USD</strong></strong>. The cost for validator #100 is less than <strong><strong>10 000 USD</strong></strong>. This state of the ecosystem may undermine the overall trust of the Cosmos network affecting decentralization even more as delegators would not even consider to stake out of the top ten experiencing frequent slashing events.</p><h1 id="conclusion"><strong>Conclusion</strong></h1><p>To sum up everything written above, we suggest, that Cosmos Hub is still in the early stage and not mature enough to rise that number <em><em>as there does not exist strong necessity to do so and outcomes are not clear enough</em></em>. In our opinion, we should take more time to establish a healthier spirit of competition <em><em>inside the existing validator's set</em></em> and see if the smaller validators in the set are able to attract new delegators and provide sustainable services.</p><p>We understand that raising the threshold may bring new players in and final intentions are positive, but there may exist an opposite direction that has negative implications in the long run. In that case, our suggestion would be to collect more empirical data and increase the threshold based on the results of the first year as we do not need to rush forward. We already saw <a href="https://twitter.com/zmanian/status/1145072296723275776?ref=p2p.org">double-sign slashing</a> and want to decrease the probability of such events being sure that the majority of validators are reliable and sustainable.</p><hr><p><strong><strong>P2P Validator</strong></strong> offers high-quality staking facilities and provides up to date information for educational purposes. Stay tuned for updates and new blog posts.</p><hr><p><strong><strong>P2P Validator</strong></strong> offers high-quality staking facilities and provides up to date information for educational purposes. Stay tuned for updates and new blog posts.</p><p><strong><strong>Web:</strong></strong><a href="https://p2p.org/?ref=p2p.org"> https://p2p.org</a></p><p><strong><strong>Stake ATOM with us:</strong></strong><a href="https://p2p.org/cosmos?ref=p2p.org"> https://p2p.org/cosmos</a></p><p><strong><strong>Twitter:</strong></strong><a href="https://twitter.com/p2pvalidator?ref=p2p.org"> @p2pvalidator</a></p><p><strong><strong>Telegram:</strong></strong><a href="https://t.me/p2pvalidator?ref=p2p.org"> https://t.me/p2pvalidator</a></p>

from p2p validator

<p>Previously <a href="https://p2p.org/economy/5-reasons-to-stake-your-atoms">we discussed</a> why staking is important for the ecosystem and how people interested in the network potential can benefit increasing their overall share without suffering from inflation implications. In this short blog post I want to cover some strategies which participants could utilize with their outcomes and possible risks.</p><p>There are three key options for stakers in existing conditions:</p><ul><li>Stake and forget</li><li>Stake and use the power of compounding in order to increase a total share of the network</li><li>Stake and save the current network share while withdrawing gains diluted by inflation from other participants who do not stake.</li></ul><p>In fact each of these options could be supplemented with the idea of diversification amongst various validators to decrease <a href="https://p2p.org/economy/slashing-overview-in-cosmos-network">slashing risk</a>.</p><p>For simplicity let’s assume that we have two delegators, the first is staking the second one is not. Initial total supply is <code>100 atoms</code> inflation is <code>7%</code>, staking ratio is equal to the target value of <code>67%</code> and considered period of observation is <code>5 years</code>.</p><h1 id="1-stake-and-forget"><strong>1) Stake and forget</strong></h1><p>This strategy may look convenient at a first glance but such behavior has many disadvantages. Inactive delegator can miss the moment when a node of a validator he bonded to goes offline for a long period resulting in slashing of a stake. Community may decide to change initial network parameters via governance. It may influence overall staking performance and an inactive delegator can miss that. In this case, accumulated rewards do not secure the cosmos hub.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2020/09/1-13.png" class="kg-image" alt loading="lazy" width="758" height="206" srcset="https://p2p.org/economy/content/images/size/w600/2020/09/1-13.png 600w, https://p2p.org/economy/content/images/2020/09/1-13.png 758w" sizes="(min-width: 720px) 720px"></figure><p>Network share growth is slowing down as rewards become diluted by inflation and in following years it will become negative. Slashing will affect the whole holdings including rewards.</p><h1 id="2-stake-and-compound"><strong>2) Stake and compound</strong></h1><p>This strategy is especially effective when inflation is rising and there exists a strong belief in future ability of atom to capture transaction fees flow from validating on different chains, issuing assets and so on. In this case, additional gains from people who do not stake are re-delegated on an annual basis.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2020/09/2-16.png" class="kg-image" alt loading="lazy" width="679" height="205" srcset="https://p2p.org/economy/content/images/size/w600/2020/09/2-16.png 600w, https://p2p.org/economy/content/images/2020/09/2-16.png 679w"></figure><p>Staking ratio stays constant so return on staking (RoS) is not changing and network share growth is stable in this example. Obviously rewards of this delegator outperformed the previous one. This strategy also has trade-offs. If a big fish bonded to a single validator or validator itself has a big stake or delegated amount, implementing this approach may lead to high network centralization and power concentration. This will not benefit network participants and would undermine security of the cosmos hub.</p><p>This scenario is also subject to slashing risk the most. To increase safety of the funds it is highly recommended to diversify stake amongst various validators even if slashing sounds like something unrealistic.</p><h1 id="3-stake-and-maintain-the-same-share-slightly-releasing-profit-exceeding-standard-inflation"><strong>3) Stake and maintain the same share slightly releasing profit exceeding standard inflation</strong></h1><p>If <code>100%</code> of total atom supply is locked in staking every holder will have equal provisions. In fact, there would be no difference in their network ownership and no one would be diluted. In this case we cannot gain extra atoms and total yield would be zero. Inflation should be considered as a <strong><strong>feature that protects ownership of the network from dilution and as a punishment for every holder who does not contribute to the cosmos hub security</strong></strong>. Profit from inflation accrues only from those who do not stake. Their network share is redistributed among others and there is always an option to withdraw this addition without ownership reduction.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2020/09/3-15.png" class="kg-image" alt loading="lazy" width="758" height="206" srcset="https://p2p.org/economy/content/images/size/w600/2020/09/3-15.png 600w, https://p2p.org/economy/content/images/2020/09/3-15.png 758w" sizes="(min-width: 720px) 720px"></figure><p>This approach is also good as a hedge against slashing in the long run. The more frequently you withdraw and sell rewards the less atoms will be affected. This way of staking is especially effective if inflation and annual RoS are falling and network ownership growth is slowing down. Selling portions of atom provisions may be considered as a hedge against price fluctuations. If atom price is expected to decrease in a particular period released profits could be used to buy back with a better price. If price is expected to rise and future dynamic is uncertain then it could be a great cure against greed and a good way to release profit without taking away the ability to generate revenue in future from assets and losing network ownership.</p><h1 id="comparison-in-dynamics"><strong>Comparison in dynamics</strong></h1><p>Let’s take <code>15 year</code> period and look at the performance of these strategies in dynamics. Initial atom supply in this example is <code>100 atoms</code>. In the beginning, four delegators have <code>10 atoms</code> each:</p><ul><li>D1 stake & forget</li><li>D2 stake and compound</li><li>D3 stake and maintain the network ownership selling the rest</li><li>D4 just hold not staking at all Inflation is <code>7%</code> staking ratio constantly rises from <code>57%</code> to <code>77%</code> with a five year stop at <code>67%</code></li></ul><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2020/09/4-10.png" class="kg-image" alt loading="lazy" width="938" height="524" srcset="https://p2p.org/economy/content/images/size/w600/2020/09/4-10.png 600w, https://p2p.org/economy/content/images/2020/09/4-10.png 938w" sizes="(min-width: 720px) 720px"></figure><p>For that period of time D1 ended with <code>34,82 atoms</code> accumulating <code>24,82 atoms</code> pending withdrawal, D2 ended with <code>98,88 atoms</code>, D3 earned <code>65,07 atoms</code> selling <code>17,32</code> of them during that time maintaining stake of <code>47,75 atoms</code> and D4 left with <code>10 atoms</code> like in the beginning. Overall holdings could be visualized in the following graph.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2020/09/5-10.png" class="kg-image" alt loading="lazy" width="1190" height="600" srcset="https://p2p.org/economy/content/images/size/w600/2020/09/5-10.png 600w, https://p2p.org/economy/content/images/size/w1000/2020/09/5-10.png 1000w, https://p2p.org/economy/content/images/2020/09/5-10.png 1190w" sizes="(min-width: 720px) 720px"></figure><p>On that graph we do not count sold atoms of D3, even so, after some time a delegator who was selling the surplus of atoms would have more holding than one who had just passively staked. If we look at a network ownership dynamics we notice that at the finish D3 maintains higher share even without increasing it. If at the end of the experiment total holdings of each delegator are affected by double-sign slashing (except D4) we see that D2 will lose twice as many as D3.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2020/09/6-6.png" class="kg-image" alt loading="lazy" width="1190" height="600" srcset="https://p2p.org/economy/content/images/size/w600/2020/09/6-6.png 600w, https://p2p.org/economy/content/images/size/w1000/2020/09/6-6.png 1000w, https://p2p.org/economy/content/images/2020/09/6-6.png 1190w" sizes="(min-width: 720px) 720px"></figure><p>In the first half of the period D1 had more atoms than D3 but It is possible to be higher on the graph for this period if D3 will release less profit and re-delegate more atoms in order to slightly increase his share but not as much as D2. For the first year you can re-delegate all provisions and slightly decrease re-delegation percentage for the following years but not breaking the initial ownership. In fact you can mix the option of compounding and partial selling in any variation that suits your expectations.</p><p>Network share changes differently for delegators. At the end of a period when inflation is decreasing because staking ratio is <code>>67%</code>, D2 experiences the highest decrease in the network share growth while others experience a decrease in their network ownership losses.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2020/09/7-4.png" class="kg-image" alt loading="lazy" width="1190" height="600" srcset="https://p2p.org/economy/content/images/size/w600/2020/09/7-4.png 600w, https://p2p.org/economy/content/images/size/w1000/2020/09/7-4.png 1000w, https://p2p.org/economy/content/images/2020/09/7-4.png 1190w" sizes="(min-width: 720px) 720px"></figure><p>Simply speaking, it becomes more reasonable to implement the strategy of D3 when annual RoS is decreasing. If RoS is rising, network share growth rate is also rising boosting total holdings.</p><h1 id="conclusion"><strong>Conclusion</strong></h1><p>We discussed various options of managing staking balance mostly for educational purposes and deeper understanding of staking process economic variables. Inflation mechanism may drastically change in the near future as it would not be necessary to hold such a high rate of dilution if there were enough economic incentives to stake for participants, and revenues from transaction fees and other options would exceed inflationary rewards providing a stable source of income for validators to maintain their infrastructure and fund operational costs.</p><hr><p><strong><strong>P2P Validator</strong></strong> offers high-quality staking facilities and provides up to date information for educational purposes. Stay tuned for updates and new blog posts.</p><hr><p><strong><strong>Web:</strong></strong><a href="https://p2p.org/?ref=p2p.org"> https://p2p.org</a></p><p><strong><strong>Stake ATOMs with us:</strong></strong><a href="https://p2p.org/cosmos?ref=p2p.org"> https://p2p.org/cosmos</a></p><p><strong><strong>Twitter:</strong></strong><a href="https://twitter.com/p2pvalidator?ref=p2p.org"> @p2pvalidator</a></p><p><strong><strong>Telegram:</strong></strong><a href="https://t.me/p2pvalidator?ref=p2p.org"> https://t.me/p2pvalidator</a></p>

from p2p validator